On the Road to Nowhere

December 20, 2022

Status Quo

July 21, 2023Wall Street Playbill

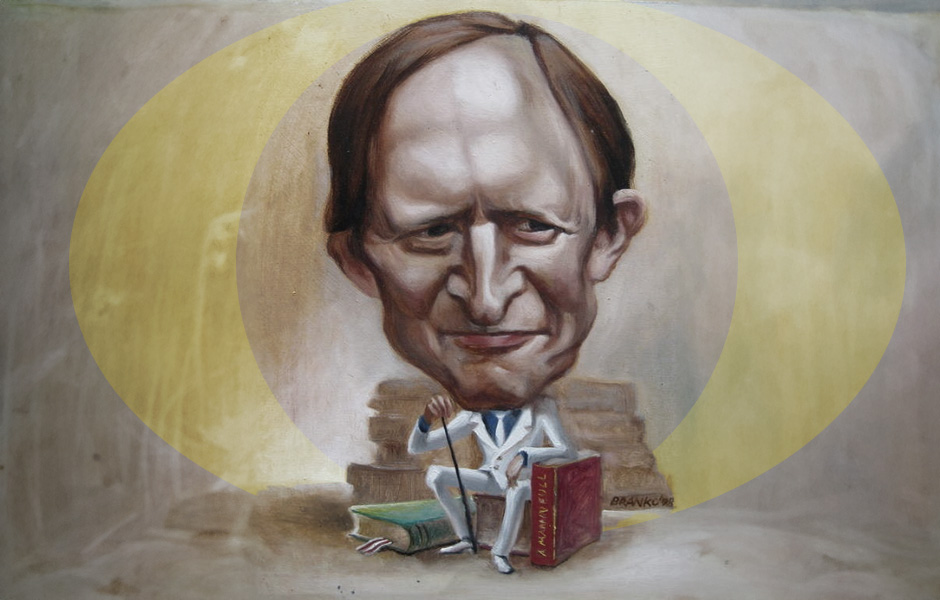

By William H. Gross | April 21, 2023

We had “Wall Street” the movie, but “Wall Street” the play seems to have had nearly a perpetual run on Broadway. The actors change, but the script never seems to. Take your seats, relax and read the current version of “Wall Street’ and its playbill.

Cast

Central Bankers –

Create money out of thin air, move interest rates up and down pretending to be prescient, yet fail to regulate the industry they oversee. When yields get to 0%, they buy bonds at superficial prices in order to fund the Treasury, and generate profits for their owners (the banks). Perpetually claim to be concerned about inflation, unemployment, and Main Street in order to justify their independence, but Wall instead of Main is typically their focus.

Bankers –

Lend money that isn’t theirs, charge you interest on it, foreclose on your home if you don’t pay it, accept a handout from the government when they get into trouble, and then perpetually complain about bonuses and regulation. Poor babies! Would they prefer to be a truck driver?

Investment Bankers –

Lever an initial investment by 30 to 1, claim they’re doing God’s work (Goldman), and when they resemble Lehman, morph into a bank (2009) with all the accouterments and associated privileges.

Hedge Fund Managers –

Convince wealthy individuals and institutions into believing that they have a monopoly on intelligence. Claim that theirs is a business of “hedging” when in fact almost uniformly they mimic long positions in the stock market. Charge investors 2% and 20 for the privilege of watching your investment dollars appreciate less than the S&P. When they underperform, they shut down and start another fund to make sure the 2/20 is still in play. Hold your nose!

Investment Management/Mutual Fund/ETF Managers –

Accept subscriptions and savings with no risk to their own capital and charge 50 to 130 basis points with the hope of generating alpha – that is beating the market. Investors somehow never understand that the market can’t outperform the market, leaving them 1% poorer on average each year. Hope springs eternal, but commonsense is lost in the confusion.

Index Fund Managers –

Claim to be 99.95% pure (5 basis point fees) and in general do a better job of preserving your money than most of the above. Interestingly though, they use fees from clients’ assets to advertise, in order to get more assets, in order to get more fees from clients. If you can’t beat the market, place ads!

Money Market Fund Managers –

Mine yielded .01% for six years until 2022. On a $100,000 investment I earned $10 per year. These managers fight legislation that would make them raise capital reserves in case of another Lehman, but expect another bailout if it happens. It’s all part of the plan to divorce you from your money, and at .01% a year, it doesn’t take long.

The Average Investor –

Financially repressed by the central bank, overcharged by their own bank, jeopardized by levered investment banks, brainwashed by hedge funds, conned by mutual funds, mediocritized by index funds, minimized by money market funds, and victimized by the entire lot. Ain’t capitalism grand!

Me –

One lucky dude, who tried to pay some of it forward at PIMCO. In my 40 years at PIMCO, I/PIMCO team probably made a lot more money for others than myself. Morningstar once wrote that I and the PIMCO team made more money for more people than anyone in history. A stretch but I’m not in the playbill.

You –

Your four-letter expletives go here _ _ _ _ ________!

Well the beat, or the “play” goes on as the opening portion of this Outlook suggests. But beating Wall Street is not quite as hard as beating a Vegas casino. The odds are much better because our Central Bank – the Fed – makes sure over time that an investor has a decent chance of beating 50/50 odds as it supplies needed liquidity at a favorable yield for borrowers. Not recently of course. The market is in a much-needed tightening cycle but tightening cycles are brief. Over the past 25 years, the cost of money for banks via the fed funds window has averaged nearly 1% less YOY than the CPI as our “finance based” economy has required greater and greater cheap money to grow credit at a rate necessary to keep nominal GDP growing at an acceptable, non-deflationary growth rate. That it has overdone it for the past five years (2.25% less) is a reflection not only of the Fed’s miscalculation of the power of fiscal deficits via congressional spending (mainly a $2 trillion annual deficit on average) but also I suggest, of the need to run larger and larger deficits. Keynes’ famous dictum to escape the Great Depression suggested the government should step in to heal the private sector by spending what businesses and consumers were unwilling to. Pretty simple it seems these days after nearly a century of doing just that, but in the 1930’s it was a rather foreign and outrageous concept. Before FDR, the theory advanced by Treasury Secretary Andrew Mellon was to “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate” in order to stabilize the economy. NOT!

But Keynes changed that as did an increasingly accommodative Fed, accelerating in 1971 as Nixon broke the gold standard and central banks worldwide learned to join their treasurys via easy money. Together, both supercharged fiscal and monetary policy has accelerated annual CPI increases over the past half century to 4.0%, from a rather benign 1.7% in the 50 years previous. Some may comment that these policy changes were a rather small price to pay for long-term real GDP growth of 3% and that may be true, but there are consequences much like global warming that can only be viewed over the long term. Our recent global “banking crisis” is but one of an increasingly frequent series of events such as the Great Recession, the dot-com crisis, and the stock market crash of 1987 that can be traced to too much money creation, too radical financial innovation (portfolio insurance in 1987) and too many fiscal deficit bailouts. The aftereffects and consequences of such bailouts are now necessitating not only their perpetuation but their acceleration. Near 0% interest rates from 2017 to 2022, quantitative easing and Covid bailouts of $2.5 trillion per year are the most recent examples.

And so? It will be extremely difficult to return to the Fed’s historic 2% inflationary target. The lesson to be learned from the paragraphs above is that higher than 2% inflation has been required to keep the U.S. and global economies growing, which in turn have been required to maintain healthy asset markets, which increasingly is the target for Fed policy despite Chairman Powell’s denials.

Investors should therefore invest with expectations for 3%-plus annual CPI gains. They should own TIPS versus nominal Treasuries. Own them in smaller size via ETFs such as STIP and VTIP. They should include commodities in a portion of their diversified portfolios. They should focus on companies with the capacity to raise prices and maintain margins in an inflationary environment (you tell me!) And also – well here’s a sidebar: Recall my beginning Wall St. playbill where I railed against banks for lending money that isn’t theirs and then being bailed out when things go wrong? Well I’ve always told myself and close friends that I wish I could start a bank. It’s a license to make money even when run conservatively. Some in recent months have hit the front pages when they weren’t so conservative – like Silicon Valley Bank which in turn produced a moderate financial crisis cratering the market prices of regional banks deemed susceptible to withdrawals of deposits. As a result many regionals are down 30%-40% since and it’s possible to own (or in effect) start a bank at 60%-70% of book value. Admittedly, regionals will have their cyclical problems if and when a recession occurs but my long-time wish to own a bank is now possible via public markets. Recent ROEs of 9%-10% at 60% of book provide an enticing long-term investment. Many smaller regionals may be gobbled up by larger counterparts at premium-to-market bids. I’ve become a banker by proxy. My purchases – not recommendations for legal purposes – include WAL, KRE (an ETF), SNV, and PACW.

Good luck to me! Best of luck to you. We both can finally join the cast of “Wall Street” – the play.