Bill Gross Is Long the Pound After Plunge With Dollar Overvalued

September 8, 2022

‘Bond King’ Bill Gross warns the Fed against raising interest rates – saying central bank hikes could spark a credit crunch and global depression

October 7, 2022Carry On

Carry on!!” was the gruff but oh so welcomed command screamed at me by Marine drill Sergeant Jo Quinn Cruz in October of 1967. Cruz was a mensch. I was a 22-year-old boy struggling to finish 50 pushups after climbing a 20-foot rope, in order to prove somehow that I had the guts to be a Naval Officer in 12 short weeks. His “carry on” was a compliment of sorts, suggesting I would live for another day. Yet Cruz was the same Marine who told me in my sixth week at Pensacola that I would “never fly jets” – blimps were more my style. He was right about the jets, except the Naval blimps were WWI vintage and beyond even my limited capacity to get them in the air.

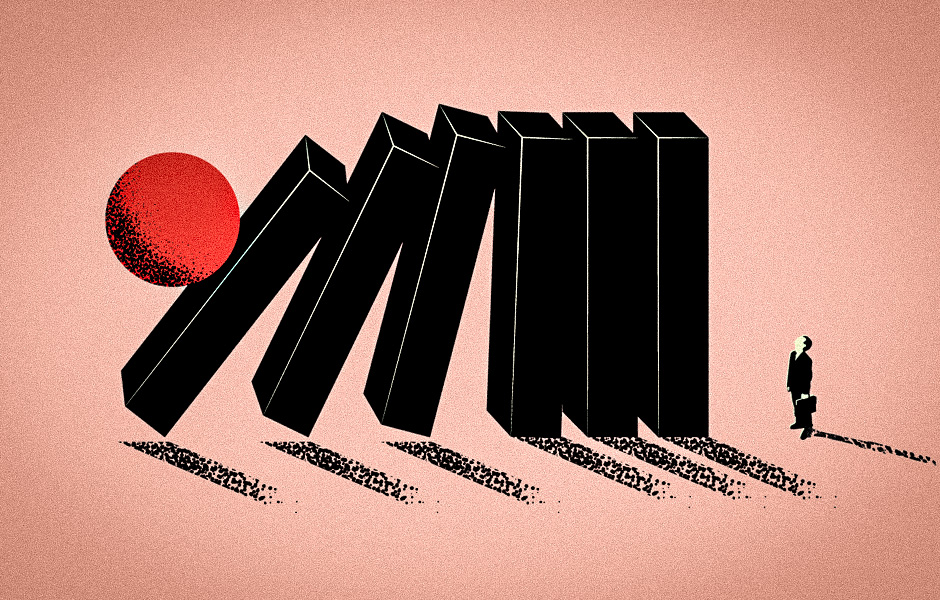

Today, his command of “Carry On” is more than apropos for U.S and other global developed economies. Without interest rate “carry” (the positive difference between 2 and 10 year treasuries, for instance), our half-century-old, financed-based economy cannot thrive. Short rates fixed appropriately by central banks have historically produced nominal GDP growth of 5% or so in the U.S. Corporations have been incented to borrow at a lower rate and lend at a higher rate, accompanied by duration and credit risk of course, but producing a profit from the “carry” if invested wisely. But without this positive “carry” lenders have been and still are reluctant to lend, and economic growth has faltered or recessed. Almost all financial-based economic activity now depends upon this “mother’s milk” called carry. Without it economies reverse direction as witnessed in U.S. recessions of 2007, 2000, 1989, and 1980/82. The longer and wider the negative carry, the deeper the recession. Paul Volcker, like my Sergeant Cruz, was a mensch. He slayed 13% inflation by inducing a negative carry of 500 basis points or more for 3 years, but an intermittent and deep three-year recession was the byproduct.

Today’s central bankers are employing the same tactics, but our significantly higher levered economy cannot withstand the same amount of negative carry. The question is – how much, and for how long? It’s a correlated but slightly different question than asking when Chair Powell will call off his inflation dogs under the assumption that inflation down the road will return to 2% or so. Different, because while inflation is the Fed’s seemingly solitary focus at the moment, economic growth and financial stability may soon gain equal measure. Recent events in the UK, cracks in the Chinese property-based economy, war and a natural gas freeze in Europe, and a super strong dollar accelerating inflation in emerging market economies, point to the conclusion that today’s 2022 global economy in no way resembles Volcker’s in 1979. A negative carry of 500 basis points now would slay inflation but create a global depression.

So where does Powell stop and for how long? Today’s negative carry of 45 basis points between 2 and 10 year Treasuries seems innocuous compared to 1979-81 but it is actually higher than the negative carry which produced each of the three recessions that followed. Ever-increasing leverage is the culprit. The U.S and other economies cannot stand many more rate increases. In my opinion, current market expectations of a Fed Funds level of 4.50% somewhere in 2023 are too high. If so, the 2 year note at 4.30% is too high as well and high-quality Treasuries across the curve have – for now – reached a temporary peak.

My portfolio is increasingly leaning toward a small percentage of medium-term bonds. Would you believe that 5-year TIPS yielded a negative 150 basis points at the start of 2022 and now approach a positive 200 basis points? Not since 2006 (the year preceding the Great Recession’s onset) have real yields been so high. So if you’re like CNBC pundits that daily argue for “defensive stocks” as in “ones that won’t go down much”, try a more aggressive but actually more conservative approach that might in fact produce future capital gains. If you are chary of buying bonds because of this year’s experience, try investing in an exchange traded fund – TIP – on the stock market which is loaded with inflation protected treasuries. That protection after all yields 2% + the currently raging CPI.