Goodnight Vietnam

August 6, 2014

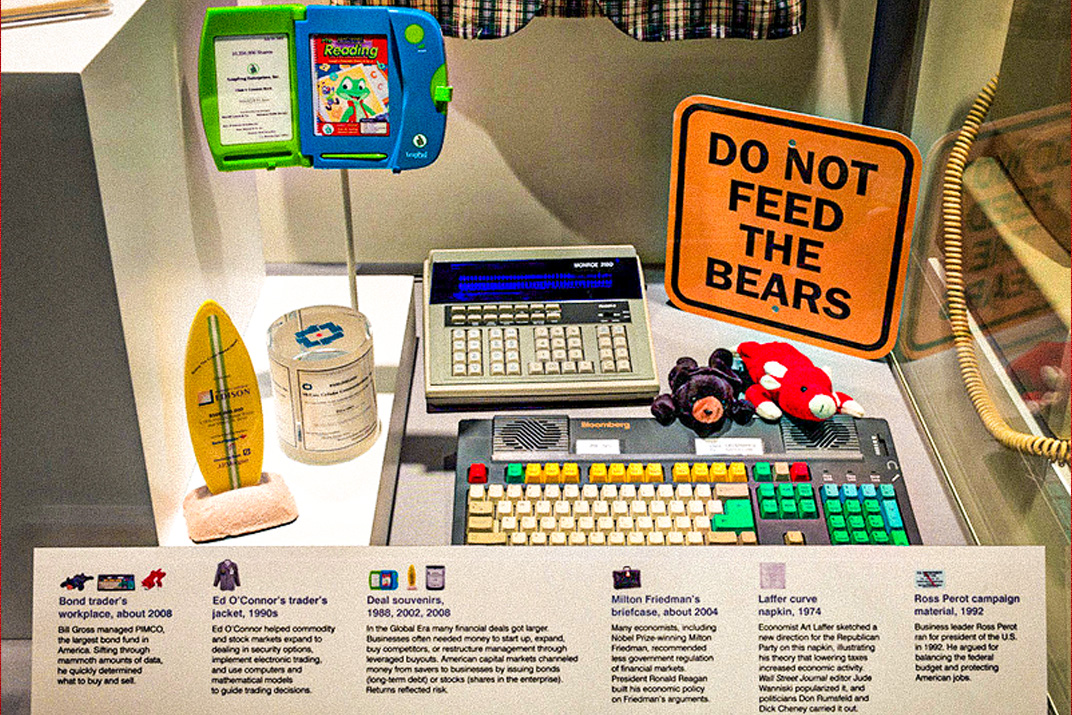

Gross’s Terminal Keyboard to Be Displayed at Smithsonian

May 29, 2015For Wonks Only

A credit-based financial economy (as opposed to pure cash) depends on an ever-expanding outstanding level of credit for its survival. Without additional credit, interest on previously issued liabilities cannot be paid absent the sale of existing assets, which in turn would lead to a vicious cycle of debt deflation, recession and ultimately depression. It is this expansion of private and public market credit which the Fed and the BOE have successfully engineered over the past five years, while their contemporaries (the ECB and BOJ) have until now failed, at least in terms of stimulating economic growth.

The unmodeled (for lack of historical example) experiment that all major central banks are now engaged in is to ask and then answer: What growth rate of credit is enough to pay prior bills, and what policy rate/amount of Quantitative Easing (OE) is necessary to generate that growth rate? Assuming that the interest rate on outstanding debt in the U.S. is approximately 4.5% (admittedly a slight stab in the dark because of shadow debt obligations), a Fed governor using this template would want credit to expand by at least 4.5% per year in order to prevent the necessary sale of existing assets (debt and equity) to cover annual interest costs. That is close to saying they would want nominal GDP to expand at 4.5%, but that’s another story I Investment Outlook.

How are they doing? Chart 1 shows outstanding credit growth for recent quarters and all quarters since January 2004. The chart’s definition of credit includes the standard Fed definition of private non-financial credit (corporations, households, mortgages), public liabilities (government debt), as well as financial credit. The current outstanding total approximates $58 trillion and has been expanding at an average annual rate of 2% for the past five years, and 3.5% for the most recent 12 months.