‘Bond King’ Bill Gross warns the Fed against raising interest rates – saying central bank hikes could spark a credit crunch and global depression

October 7, 2022

Bill Gross Criticizes ‘Total Return’ Bond Funds He Popularized

October 18, 202250 Basis Deposit/

No Return

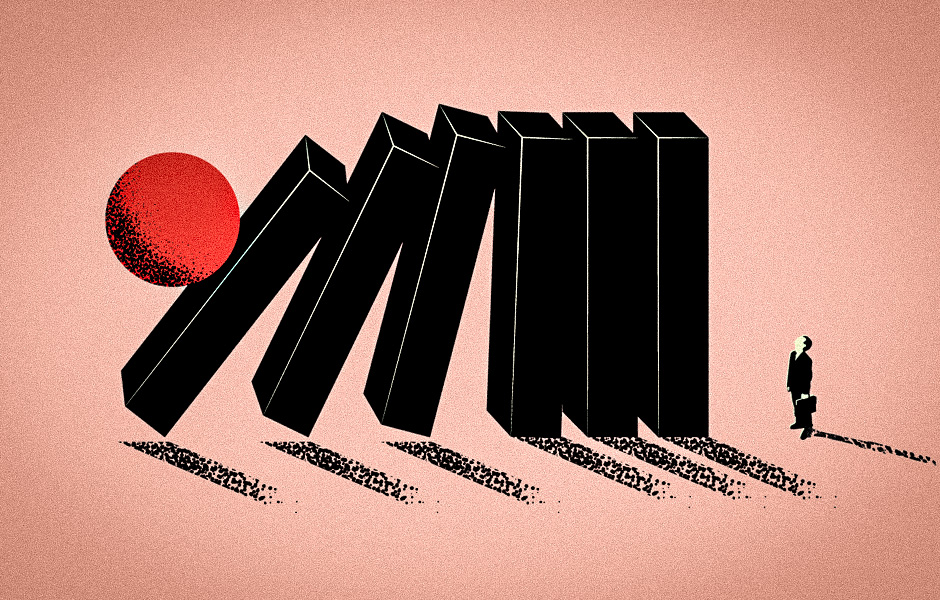

There are lots of “total return” bond funds these days, almost a half century since I innovated the concept in 1987. My idea then was to combine interest income with capital gains in bond prices to produce a “total return” over and above current yields. It worked famously until the beginning of this year as shown in the below chart. Admittedly, a secular bond bull market was a huge tailwind, but Pimco’s “Total Return Fund” used a host of other non-index strategies to differentiate itself from the pack. The years 2007-2009 were particularly reflective – voiding subprime mortgages much like Michael Burry’s “Big Short” in hedge fund space. It led to the doubling of Pimco’s total assets from $1 trillion to $2 trillion in the following few years.

The end of total return. Source: Bloomberg

But sometime between my departure in 2014 and now, Pimco and other leading proponents of the concept including self-anointed “bond king” Jeffrey Gundlach at DoubleLine, have lost their total return “charter”, or vision, of what such funds should offer to investors in the form of capital preservation. YTD returns for that and Pimco’s fund are down between 16% and 18% with 50 basis points tacked on for your investment pleasure.

When I say these and other total return bond funds have lost their “charter”, I’m asserting that almost all of these funds have in the last five years become quasi “index funds”. And since most adhere to indices with six year and longer durations, their performance has reflected the increase in 10 yield Treasury yields from 1.5% to the current 3.9% level. Admittedly, even a low duration fund would have had trouble showing returns above the line this year. But -15%? These total return funds are actively managed with the ability to go low in terms of maturity duration, but they all seem to be chasing “index-plus” performance as opposed to “total return” management. Perhaps they should all change their names to “index plus” to reflect that reality.

If so, investors with assets in the hundreds of billions might have been more cautious with their 401K allocations, and pension and insurance balance sheets might have done the same. Individual investors check the “401K box” for these funds, believing that they will produce a defensive return in times of stress. They have been misled. Would they have preferred to pay 50 basis points for the privilege of outperforming a bond market index and losing 15% of their money?

My suggestion? Change their names, or perform their original mission of returning current bond market yields plus alpha from non-durational sources. This year, a 2% average yield could have been bolstered by defensive credit and yield curve strategies that were alpha generating. ‘Nuff said I guess. But looking forward, one- to five-year dated TIPS look to produce positive returns from here as breakeven yields of 2% anticipating a quick return to yesteryear’s inflation give a decided advantage to “inflation-protected” bonds as opposed to nominal Treasuries and total return funds. I have been investing in an ETF that charges only .03% in fees and is accurately labeled as “iShares 0-5 Year TIPS Bond ETF” with the NYSE stock symbol of “STIP”. Truth in advertising.

STIP may save you some money versus total return funds.