‘Bond King’ Bill Gross Sells Rare Stamp for Record $4.4 Million

June 14, 2024

Value Versus Growth

July 30, 2024Credit Supernova!

(Redux)

By William H. Gross | June 27, 2024

This is the way the world ends…

Not with a bang but a whimper.

-T.S. Eliot

This rather macro-oriented Outlook was originally written in 2013 and is included in my new online book, The Bond King’s Greatest Hits; A Selection of the Best Investment Outlooks Over the Past 46 Years as Chosen by Bond King Bill Gross, that can be ordered here. It was one of my best ever and intended — as I wrote then — to explain our finance-based credit system. It offered no immediate forecast for what I labeled a “Credit Supernova” but suggested over time that a gradual “implosion” of credit’s potency would have longer-term consequences.

I have updated the investment consequences from now to an indefinite future: keep bond durations short; expect low single-digit returns from stocks; consider commodities; don’t invest exclusively in the U.S., despite its more dynamic economy due to AI.

Take your time to digest this. I’m a firm believer in our Credit Supernova.

They say that time is money.* What they don’t say is that money may be running out of time.

There may be a natural evolution to our fractionally reserved credit system which characterizes modern global finance. Much like the universe, which began with a big bang nearly 14 billion years ago, but is expanding so rapidly that scientists predict it will all end in a “big freeze” trillions of years from now, our current monetary system seems to require perpetual expansion to maintain its existence. And too, the advancing entropy in the physical universe may in fact portend a similar decline of “energy” and “heat” within the credit markets. If so, then the legitimate response of creditors, debtors and investors inextricably intertwined within it, should logically be to ask about the economic and investment implications of its ongoing transition.

But before mimicking T.S. Eliot on the way our monetary system might evolve, let me first describe the “big bang” beginning of credit markets, so that you can more closely recognize its transition. The creation of credit in our modern-day fractional reserve banking system began with a deposit and the profitable expansion of that deposit via leverage. Banks and other lenders don’t always keep 100% of their deposits in the “vault” at any one time – in fact they keep very little – thus the term “fractional reserves.” That first deposit then, and the explosion outward of 10x and more of levered lending, is modern day finance’s equivalent of the big bang. When it began is actually harder to determine than the birth of the physical universe but it certainly accelerated with the invention of central banking – the U.S. in 1913 – and with it the increased confidence that these newly licensed lenders of last resort would provide support to financial and real economies. Banking and central banks were and remain essential elements of a productive global economy.

But they carried within them an inherent instability that required the perpetual creation of more and more credit to stay alive. Those initial loans from that first deposit? They were made most certainly at yields close to the rate of real growth and creation of real wealth in the economy. Lenders demanded that yield because of their risk, and borrowers were speculating that the profit on their fledgling enterprises would exceed the interest expense on those loans. In many cases, they succeeded. But the economy as a whole could not logically grow faster than the real interest rates required to pay creditors, in combination with the near double-digit returns that equity holders demanded to support the initial leverage – unless – unless – it was supplied with additional credit to pay the tab. In a sense this was a “Sixteen Tons” metaphor: Another day older and deeper in debt, except few within the credit system itself understood the implications.

Economist Hyman Minsky did. With credit now expanding, the sophisticated economic model provided by Minsky was working its way towards what he called Ponzi finance. First, he claimed the system would borrow in low amounts and be relatively self-sustaining – what he termed “Hedge” finance. Then the system would gain courage, lever more into a “Speculative” finance mode which required more credit to pay back previous borrowings at maturity. Finally, the end phase of “Ponzi” finance would appear when additional credit would be required just to cover increasingly burdensome interest payments, with accelerating inflation the end result.

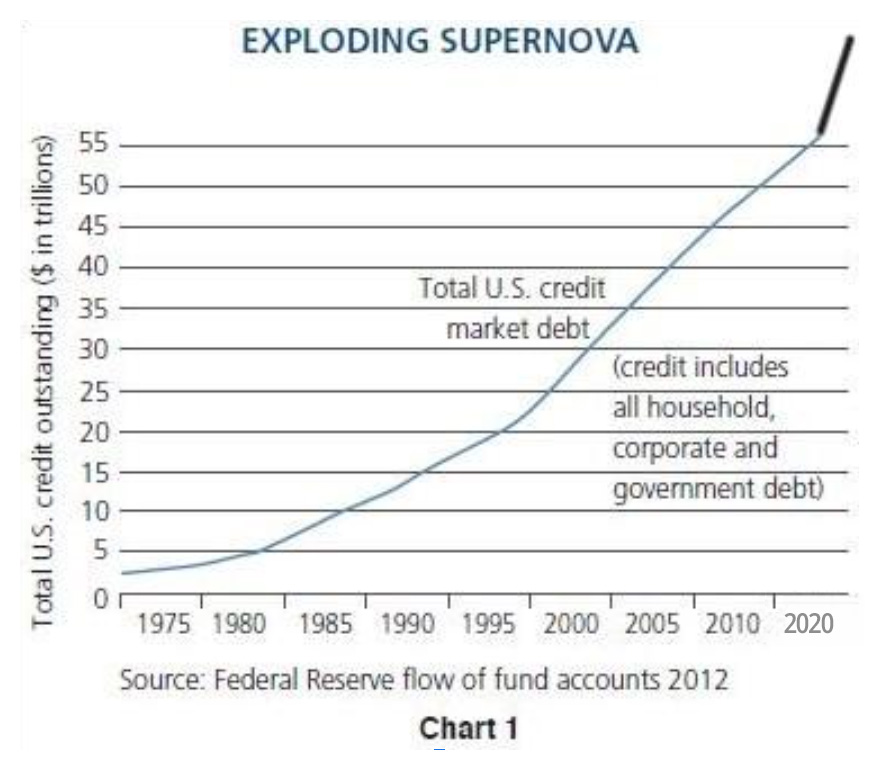

Minsky’s concept, developed over a half century ago shortly after the explosive decoupling of the dollar from gold in 1971, was primarily a cyclically contained model which acknowledged recession and then rejuvenation once the system’s leverage had been reduced. That was then. He perhaps could not have imagined the hyperbolic, as opposed to linear, secular rise in U.S. credit creation that has occurred since as shown in Chart 1. (Patterns for other developed economies are similar.) While there has been cyclical delevering, it has always been mild – even during the Volcker era of 1979-81. When Minsky formulated his theory in the early 70s, credit outstanding in the U.S. totaled $3 trillion.† Today, at $85 trillion and counting, it is a monster that requires perpetually increasing amounts of fuel, a supernova star that expands and expands, yet, in the process begins to consume itself. Each additional dollar of credit seems to create less and less heat. In the 1980s, it took four dollars of new credit to generate $1 of real GDP. Over the last decade-plus, it has taken $20 to produce the same result. Minsky’s Ponzi finance since 2013 goes more and more to creditors and market speculators and less and less to the real economy. This “Credit New Normal” is entropic much like the physical universe and the “heat” or real growth that new credit now generates becomes less and less each year: 2.6% real growth over the past 10 years since 2014 instead of an historical 3.5% over the past 50 years; likely even less as the future unfolds.

Investment Strategy

If so then the legitimate question is: how much time does money/credit have left and what are the investment consequences between now and then? Well, first I will admit that my supernova metaphor is more instructive than literal. The end of the global monetary system is not nigh. But the entropic characterization is most illustrative. Credit is now funneled increasingly into market speculation as opposed to productive innovation. Asset price appreciation as opposed to simple yield or “carry” is now critical to maintain the system’s momentum and longevity. Investment banking, which more than a decade ago promoted small business development and transition to public markets, now is dominated by leveraged speculation and the Ponzi finance Minsky once warned against.

So our credit-based financial markets and the economy it supports are levered, fragile and increasingly entropic – it is running out of energy and time. When does money run out of time? The countdown begins when investable assets pose too much risk for too little return; when lenders desert credit markets for other alternatives such as cash or real assets.

REPEAT: THE COUNTDOWN BEGINS WHEN INVESTABLE ASSETS POSE TOO MUCH RISK FOR TOO LITTLE RETURN.

Visible first signs for creditors would logically be 1) long-term bond yields too low relative to duration risk. With the 30 year at 4.5% and durations at 15 years+, 30 basis points higher yields eliminate one-year income; 2) credit spreads too tight relative to default risk and 3) PE ratios too high relative to growth risks.

The element of time is critical because investors and speculators that support the system may not necessarily fully participate in it for perpetuity. What else can investors invest in? We operate in a world that is primarily credit based and as credit loses energy we should acknowledge its entropy, which means accepting lower returns on bonds, stocks, real estate and derivative strategies that likely will produce less than double-digit returns.

Still, investors cannot simply surrender to their entropic destiny. Time may be running out, but time is still money as the original saying goes. How can you make some?

- Position for continued inflation: the end stage of a supernova credit explosion is likely to produce more inflation than growth, and more chances of inflation as opposed to deflation. In bonds, buy inflation protection via TIPS; shorten maturities and durations; don’t fight central banks and their sovereign treasuries; own short maturities; look as well for offshore sovereign bonds with positive real interest rates (Mexico and France for example).

- Get used to slower real growth: QEs and zero-based interest rates have negative consequences because of the Fed’s tardy response.

- Invest in global equities with stable cash flows that should provide historically lower but relatively attractive returns.

- Transition from financial to real assets if possible at the margin: buy something you can sink your teeth into – gold, other commodities, anything that can’t be reproduced as fast as credit.

- Be cognizant of property rights and confiscatory policies in all governments. Expect deficits in the U.S. of 5% of GDP or more.

- Appreciate the supernova characterization of our current credit system. At some point it will transition to something else.

We may be running out of time, but time will always be money.

* The terms “money” and “credit” are used interchangeably in this IO. Purists would dispute the usage and I would agree with them, arguing for the usage for simplicity’s sake and the evolving homogeneity of the two.

† Outstanding credit includes all government debt as well as corporate, household and personal debt. Does not include “shadow” debt estimated at $20-30 trillion.